If You Want to Include or Exclude a Child from Your Estate Plan, You Must Say So Clearly

Estate planning can be an emotional and complex process, especially when it comes to your children. For most people, naming their children as beneficiaries in a will or trust seems obvious—but failing to mention a child at all, even by accident, can lead to litigation, court battles, and unintended outcomes.

In California, if a parent dies without explicitly including or excluding a child in their estate plan, the law often presumes it was an oversight, not a decision. That presumption can drastically alter how the estate is distributed. A child you never intended to inherit anything might end up receiving a significant portion of your assets. A child you meant to provide for could be left out entirely if their name isn’t included.

At Trust Law Partners, we represent beneficiaries in high-stakes trust and estate disputes. Many of our cases involve questions of whether a child was accidentally left out of a trust—or deliberately disinherited. These disputes are often avoidable. The solution lies in clear, specific language that leaves no doubt about the parent’s intentions.

How Children are Treated Under California Law

Here’s what every parent in California should know about how children are treated under the law—and what can go wrong when your documents aren’t crystal clear.

In California, Probate Code § 21620 through § 21623 deals with what’s known as a “pretermitted child”—a child who was unintentionally omitted from a will or trust. If a parent dies and fails to mention one of their children in the estate plan, the law assumes the child was forgotten, not disinherited, unless there is strong evidence to prove otherwise.

Under these rules, a child who was left out may still be entitled to a share of the estate if:

- The child was born or adopted after the parent created their estate plan, and

- The parent did not update the estate plan to reflect this new child, and

- There is no clear statement in the estate documents indicating that the omission was intentional.

This applies to both biological and legally adopted children. Stepchildren, foster children, and others may not receive the same protections unless they are explicitly included in the documents.

The law is designed to protect children from being accidentally overlooked. But when applied to real-life estate plans, it often results in legal conflict. One sibling might argue the omission was deliberate. Another might insist it was an oversight. And if the documents don’t clearly answer that question, the case can end up in court.

We’ve represented many clients whose loved one failed to make their intentions clear. Often, the person drafting the trust or will believed their wishes were obvious. They assumed their children would “know what they meant.” But in estate litigation, assumptions are dangerous.

For example:

- A parent disinherits one child due to estrangement but never writes it down.

- A trust leaves everything to “my children” but does not define who that includes—raising questions about adopted children, stepchildren, or children from prior relationships.

- A parent provides significant lifetime gifts to one child but doesn’t mention that these should offset their share of the inheritance.

- A child born after the estate plan was created is never added to the trust—and the documents don’t explain why.

In each of these cases, the court must determine what the parent intended. If the documents are vague or silent, the court may end up rewriting the estate plan based on legal presumptions.

Even worse, family members may start pointing fingers. One child accuses another of manipulation. A sibling challenges the mental capacity of the parent. What should have been a straightforward distribution turns into a bitter legal battle—one that drains the estate and damages relationships.

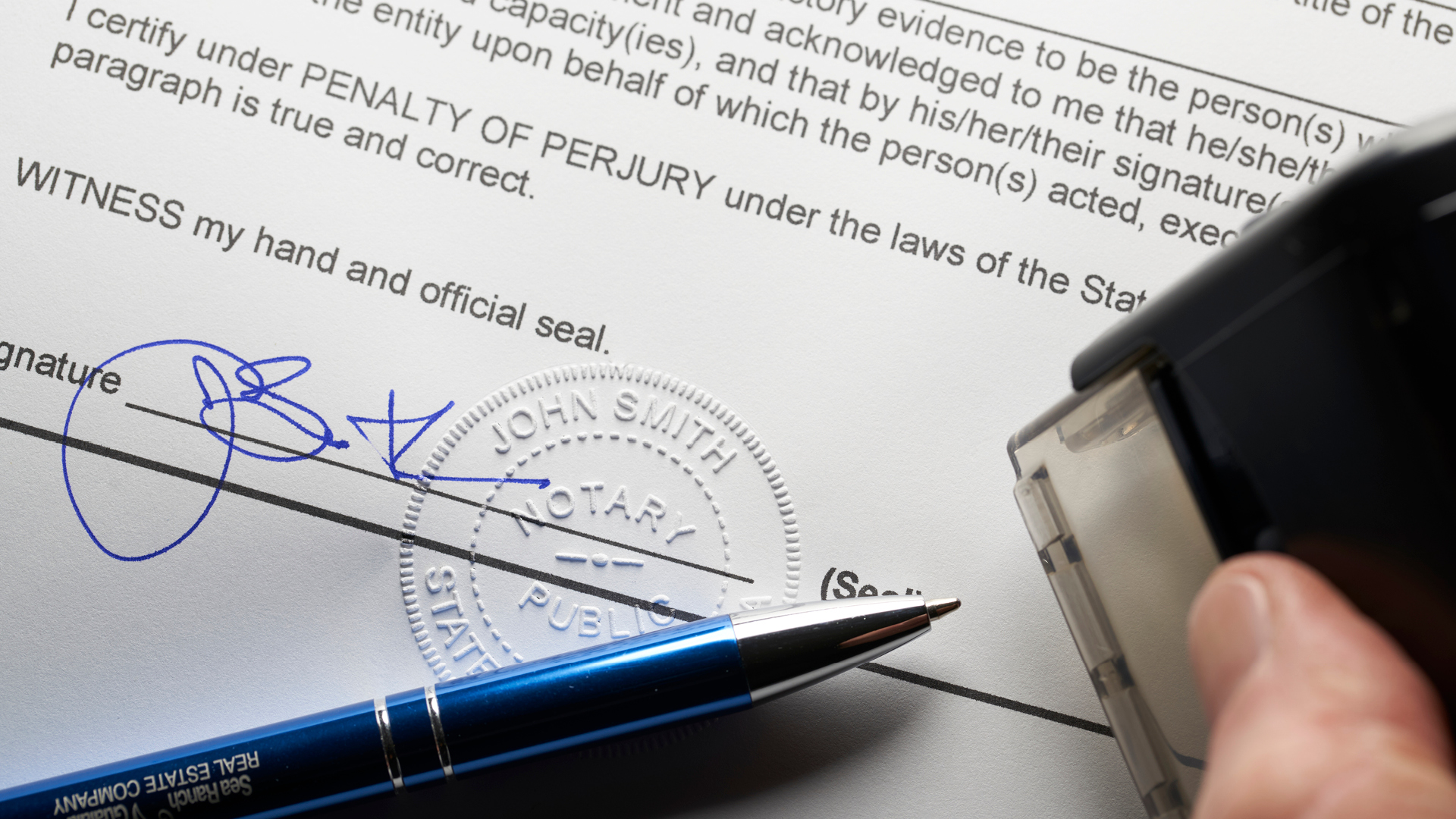

Disinheriting a child is a personal decision that must be documented with care. California law allows parents to exclude children from their estate plan, but the omission must be intentional and unambiguous.

You don’t have to give a reason, but you do have to be clear. If you intend to disinherit a child, your estate plan should:

- Name the child explicitly

- State that they are being disinherited

- Make clear that this is a conscious decision, not an oversight

Some people choose to include a brief explanation, such as a history of estrangement, financial independence, or prior gifts. Others keep it simple with a line like, “I intentionally make no provision for my son, John.”

In either case, you must name the child. Simply omitting their name can trigger a claim that they were forgotten.

We’ve seen cases where parents believed they were doing the right thing by saying “I leave everything to my beloved daughter,” without mentioning their other children. In court, this type of language invites challenges from omitted siblings. Was it intentional? Did the parent forget? Were they pressured? Without a clear statement, there’s no way to know for sure.

Blended families add another layer of complexity. In California, stepchildren do not automatically inherit unless they are legally adopted or specifically named in a will or trust. Children from prior marriages are especially vulnerable to being unintentionally disinherited when a parent remarries and updates their estate plan without including all their children.

Common problems include:

- Naming a new spouse as sole beneficiary without accounting for children from a first marriage

- Relying on vague terms like “my family” or “my heirs”

- Using joint tenancy or beneficiary designations that pass assets outside the trust, bypassing the intended children entirely

If your estate plan doesn’t account for all your children—biological, adopted, or from prior marriages—you are opening the door to confusion, resentment, and litigation.

Prior Financial Gifts Given to Children Don’t Offset Their Inheritance Unless Clearly Stated in Writing

Another common mistake is assuming that giving a child money during your lifetime counts as their share of the estate. Unless your estate plan says so, it doesn’t.

In California, there is no automatic “advancement” rule. If you gave one child $100,000 while you were alive and left nothing in writing, that gift will not reduce their share of your estate—unless you included a clear written instruction in your trust or will.

We’ve handled cases where one sibling received years of financial support, housing, and business funding, while the others received nothing. When the parent passed away, the documents made no mention of these prior gifts. As a result, the supported child claimed an equal share—leading to years of litigation.

To avoid this, your estate plan should:

- List any significant gifts made during your lifetime

- Indicate whether they should offset that child’s inheritance

- Confirm whether the child is receiving more, less, or nothing at all due to these past distributions

Online templates and fill-in-the-blank wills are not designed to handle the real-life complexities of family relationships. They rarely provide the structure needed to include or exclude children properly. Worse, they often use generic language like “my descendants” or “all my children,” which leaves too much room for interpretation.

If you have a blended family, estranged children, disabled dependents, or complex relationships, a DIY estate plan will almost always fall short. These documents may seem convenient at first, but they often end up being the root cause of trust litigation later on.

Our firm has represented dozens of clients who ended up in court because a parent used a do-it-yourself will and left out critical details. In most of those cases, the result was either a lengthy court battle or the complete unraveling of the parent’s original intent.

Be Specific

The single best way to protect your wishes—and your children—is to be specific. Your estate plan should name every child you’ve had, even if they are receiving nothing. If you want to treat children differently, say so. If you want one child to receive more or less, say so. And if you want to disinherit a child entirely, say that too.

Being explicit does not mean being harsh. It simply means making your intentions legally clear so no one has to guess later.

An experienced estate planning attorney can help you structure your plan to reflect your values while minimizing the risk of litigation. This includes using custom trust language, incorporating explanations where needed, and planning for future changes like remarriage, new children, or changing relationships.

If you’ve been left out of a parent’s estate and believe it was a mistake—or if you’re being forced to defend against a challenge from a disinherited sibling—Trust Law Partners can help.

We often represent beneficiaries in these situations where children are not named in a trust or will. Our role is to protect your rights when a trust or will is unclear, manipulated, or unfair. Whether you need to challenge a document, enforce a gift, or remove a trustee who’s failing to act, we bring strategic legal action to resolve these disputes.

And if you’re reading this because a parent or loved one is still alive, we strongly encourage you to have these conversations now. The cost of clear estate planning is minor compared to the emotional and financial toll of litigation later.

If you're involved in a trust or estate dispute involving omitted or disinherited children—or if you're worried your loved one’s estate plan is unclear—Trust Law Partners, LLP can help. Call us at 833-878-7852 for a confidential consultation.